In the world of business there is nothing more important than your reputation, and the best way to protect it is by controlling the quality of your product.

Read More

Running your own business means wearing a lot of hats, from office cleaner and supplies buyer to client schmoozer and payroll maker. But should you add a tax preparer to your already long list of duties? What if you have a tax problem with the IRS? What if doing your own taxes creates a tax problem?

Read More

According to the IRS, more than 13.2 million Americans owe back taxes. The majority of these cases involve amounts that seem impossible to pay off.

Read MoreWhether intentional or not, your business has priorities. But do you know what they are? And are they moving you in the right direction? Here’s what you need to know.

No matter what line of work you’re in, there is one thing that can help you become more successful. How are you exercising your creativity?

Are you an expert in a very specific kind of accounting? Does your audience know that? Here are two reasons you need to find an accounting niche.

It can be a stressful experience preparing your taxes and filing them. It can be even more stressful however if you make these mistakes that land you into tax trouble. It's important to remember that if you make mistakes that are serious enough, you might end up triggering an audit of your tax return or owe more in back taxes.

Read MoreYou can invest in tools and programs that promise to help you grow your business, but if you’re not working with accurate data, you’ll always fall behind.

You work hard and have big dreams for your business. But are you, as the leader of your team, setting a good example by spending your time wisely?

The stunning rise in the value of Bitcoin, along with the myriad of cryptocurrencies, is surely one of the biggest financial stories of the 21st century, at least so far.

Read MorePeople don’t generally make tax mistakes on purpose. More often they happen by accident and go unaddressed out of fear. Here’s how you handle unfiled taxes.

Where on your list of priorities does managing your business’ accounting fall? We think it should be at the top and here are some tips for achieving that.

If you owe money to the IRS, it might sound like common sense to try to tackle your tax problem on your own. However, one of the worst things you could do is talk to the IRS directly without proper representation.

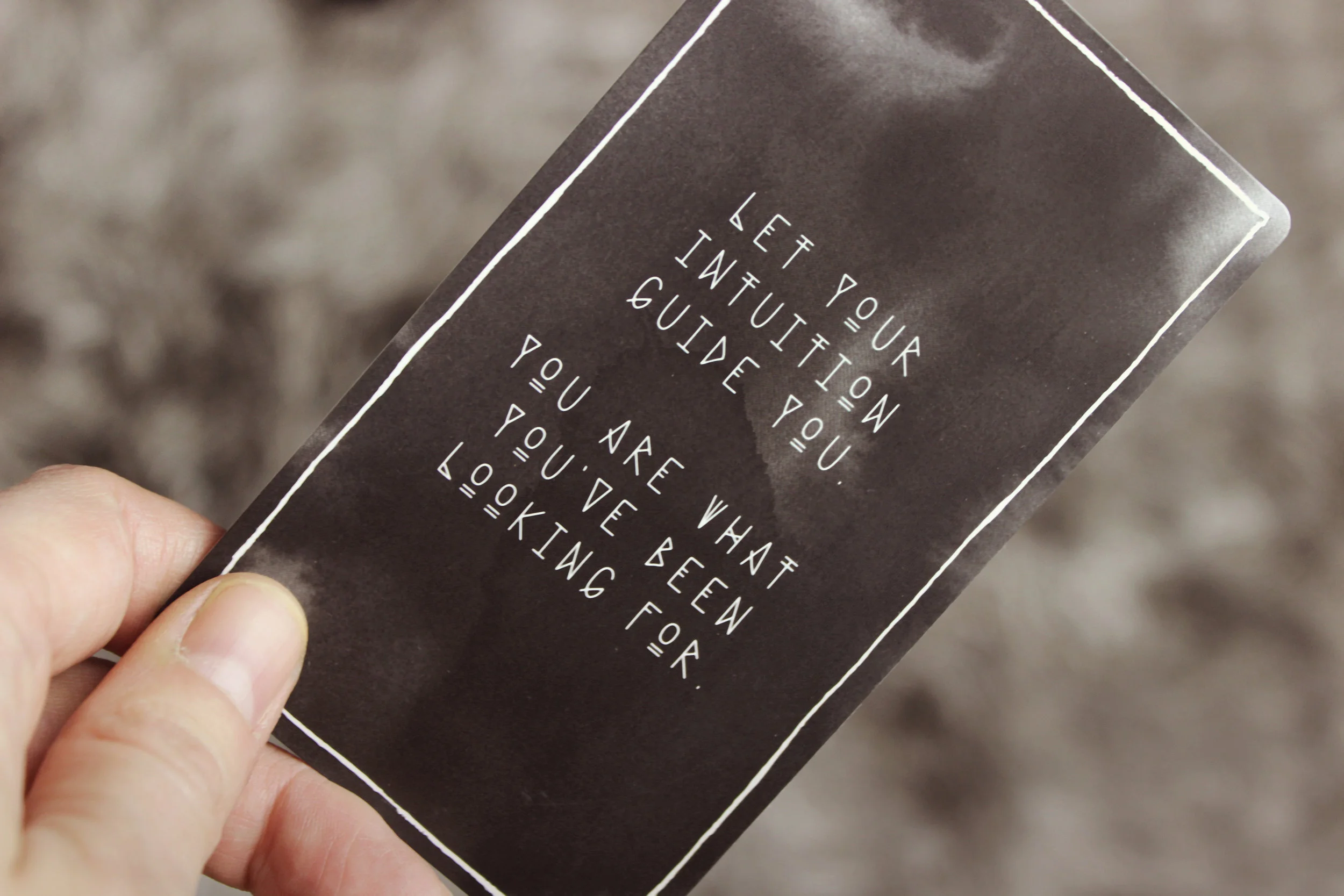

Read MoreWe’re all built with an internal compass that we like to call our “gut” or our intuition. But how do we get better at listening to it when it matters most?

We know, we hear it all the time, you’re terrified to mess up when communicating with the IRS. So why not let us take over and help you navigate their system?

Are you looking for the bookkeeper of your dreams to help manage your finances and grow your business? Here are some tips to finding the right person.

Read MoreWe’ll help you take charge of your business’ financial situation by educating yourself on some of this key business accounting basics terminology.

Read MoreAs money comes in, are you doing your best to set some aside for potential expenses you may incur? If not, you may need to develop a plan for taxes.

You work so hard to have a successful career, but is all that work keeping you from having a healthy life? Here are some tips for finding balance.

Have you recently found out that you owe money to the IRS. We know how scary this can be, but did you know that you can set up an IRS payment plan?