We’ll help you take charge of your business’ financial situation by educating yourself on some of this key business accounting basics terminology.

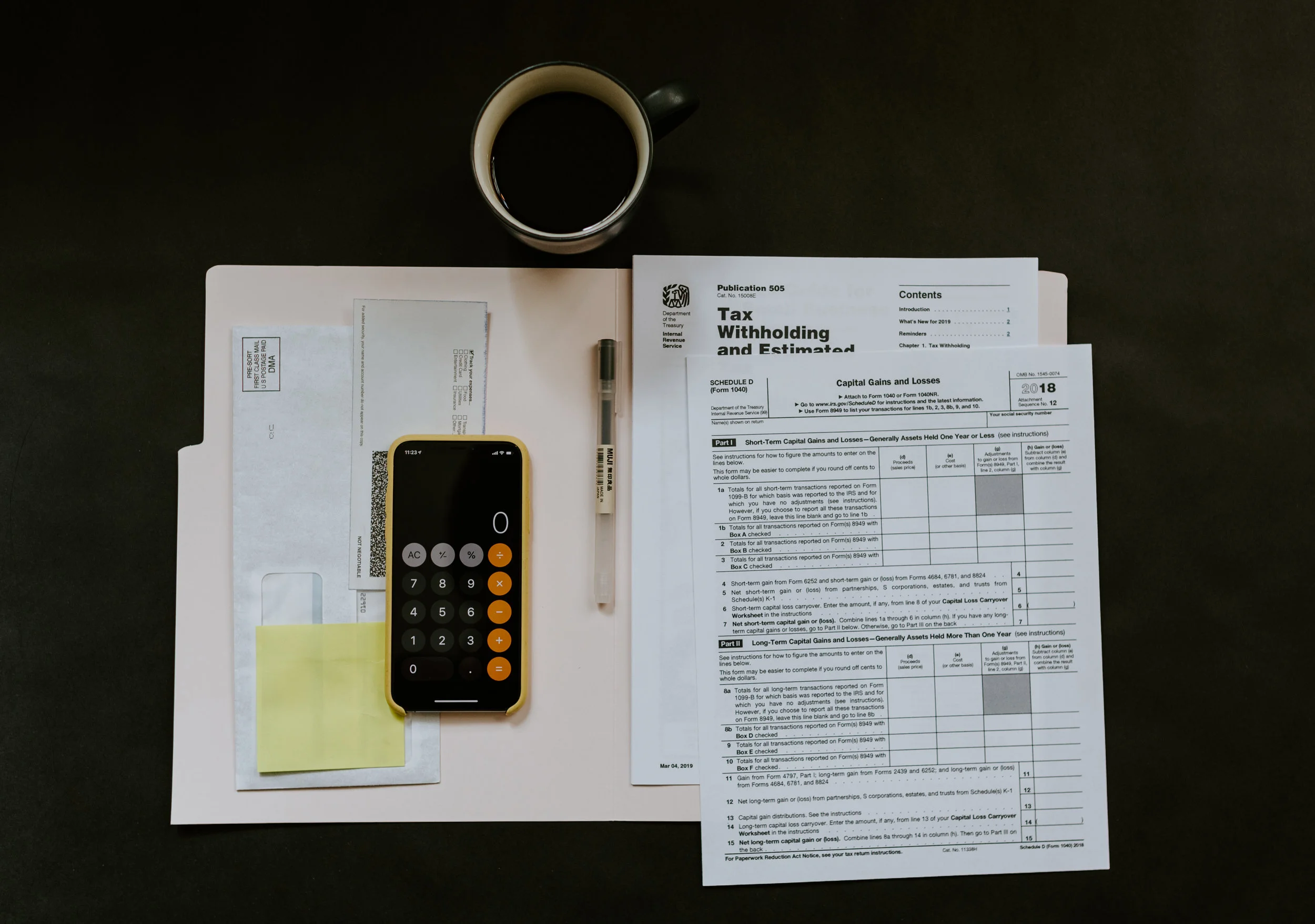

Read MoreAs money comes in, are you doing your best to set some aside for potential expenses you may incur? If not, you may need to develop a plan for taxes.

You work so hard to have a successful career, but is all that work keeping you from having a healthy life? Here are some tips for finding balance.

Have you recently found out that you owe money to the IRS. We know how scary this can be, but did you know that you can set up an IRS payment plan?

The Big Four accounting firms play an important role, but are you sure they are the right fit for you? Here are a few benefits of hiring small accounting firms.

Read MoreFailures can be frustrating and even disheartening, but they are also inevitable when building a business. Here are some tips to overcome failure.

Do you have a balance sheet yet? If not you’re probably wondering what’s the big the deal. Here is what you need to know about building your own balance sheet.

Do you have any idea how much time you or someone on your team spends working on payroll each month? It’s probably too much and here’s what you can do about it.

Read MoreThe world is full of good ideas, and creative people like you have more than most. But how do you discern which ideas are worth chasing? Here are some tips.

Read MoreIf you ask us, you should always avoid paying small business expenses in cash. Here are some tips to help your accounting team make the transition.

Read MoreCongratulations on starting your new business! Now it’s time to decide if you want to be an LLC or an S Corporation. Here are some tips to help make that choice.

Read MoreIf you’ve recently discovered that a tax lien has been placed against you, don’t panic. This situation is easily resolved by partnering with a tax expert.

Read MoreIs the fear of failure holding you back from meeting your potential as an entrepreneur? Learn how failing now helps set you up for a successful future.

Read MoreHave you found yourself in a tax situation that you can’t handle alone? Here’s another example of how we’ve resolved tax issues for clients in the past.

Read MoreWhen working to build your own business it’s important to be up on your business accounting basics. Here are some tips on reading your income statement.

Read MoreRunning a business is a big job that requires focus and attention. But how do you balance business with the rest of your life? Here are three helpful tips.

Read MoreWhy waste another moment worrying about your business’ bookkeeping when you can outsource those duties to a professional monthly bookkeeping service.

Read MoreAre you doing all that you can to save your company money? Here are some of the tax credits and deductions that you should be taking advantage of.

Read MoreDo you keep your business and personal finances separate? Well you should! And here are a few ways to separate your finances and grow your business.

Read MoreAre you a business owner or are you an entrepreneur? You may not think there's a difference, but one is a better approach to growing the business of your dreams.